SP500 LDN TRADING UPDATE 12/2/26

SP500 LDN TRADING UPDATE 12/2/26

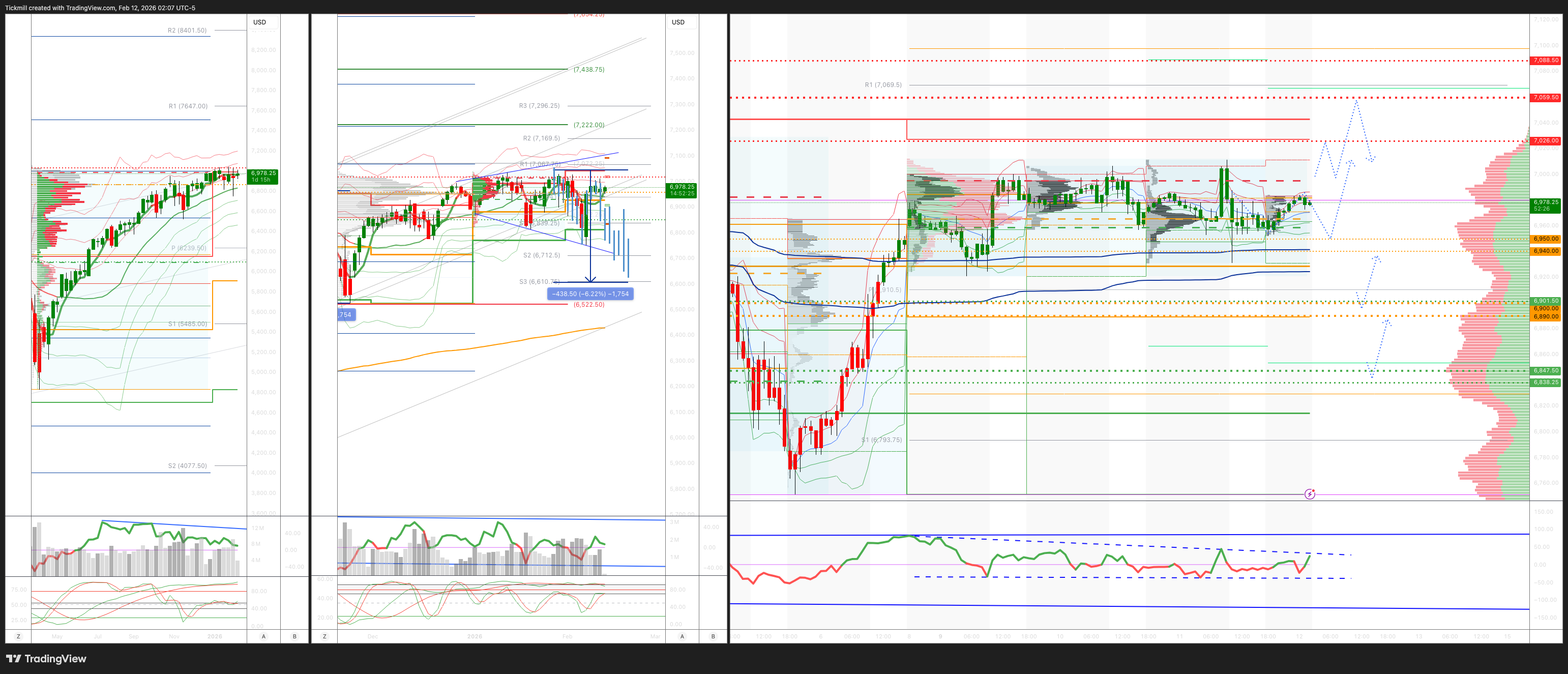

WEEKLY & DAILY LEVELS

***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***

WEEKLY BULL BEAR ZONE 6900/6890

WEEKLY RANGE RES 7059 SUP 6847

FEB OPEX STRADDLE 6726/7154

MAR QOPEX STRADDLE 6466/7203

DEC 2026 OPEX STRADDLE 5889/7779

DAILY VWAP BULLISH 6963

WEEKLY VWAP BEARISH 6967

MONTHLY VWAP BULLISH 6901

DAILY STRUCTURE – BALANCE - 7011/6924

WEEKLY STRUCTURE – BALANCE - 7031/6801

MONTHLY STRUCTURE – TBC

DAILY BULL BEAR ZONE 6940/50 (GAMMA FLIP 6944)

DAILY RANGE RES 7026 SUP 6901

2 SIGMA RES 7088 SUP 6838

VIX BULL BEAR ZONE 20

PUT/CALL RATIO 1.01 (The numbers reflect options traded during the current session. A put-call ratio below 0.7 is generally considered bullish, and a put-call ratio above 1.0 is generally considered bearish)

TRADES & TARGETS

LONG ON REJECT/RECLAIM DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

SHORT ON REJECT/RECLAIM OF WEEKLY/DAILY RANGE SUP TARGET 6985

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE ABOVE OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEW - ‘AI Angst…Again’

S&P closed flat at 6,942 with a Market-on-Close (MOC) imbalance of $170 million to sell. The Nasdaq 100 (NDX) rose +29bps to 25,201, while the Russell 2000 (R2K) dropped -38bps to 2,669, and the Dow fell -13bps to 50,121. Total US equity trading volume reached 20.88 billion shares, exceeding the year-to-date daily average of 19.51 billion shares. The VIX declined -79bps to 17.65. WTI Crude surged +169bps to $65.04, the US 10-Year Treasury yield increased +3bps to 4.17%, gold gained +134bps to $5,092, the DXY rose +14bps to 96.93, and Bitcoin dropped -155bps to $67,551.

Despite the S&P's flat close, the market felt far from calm, with significant de-grossing activity underway as debates about AI's sectoral impact remained a key focus. Financials faced heightened pressure as selling cascaded through sub-sectors, particularly Commercial Real Estate (CRE) Brokers & Services, with no notable defense ahead of CBRE's earnings tomorrow. Christian DeGrasse noted the sequence of events: systematic selling began with lower-rate-exposed names in Financials (excluding REITs), followed by positioning pain and de-grossing. Crowding in the sector exacerbated relative performance disparities, leading to Financials' underperformance being attributed to AI concerns. The Long Software vs. Short Semis Pair (GSPUSOSE) saw a sharp 3-sigma move lower, ending -7.5%. Rotational pressure was evident, with Software falling sharply after a recent +8% rally over three days. Key names like U, FRSH, PEGA, and VERX all dropped 10%+, while Semiconductors surged on strong datapoints from VRT (+25%), LSCC (+16%), and MU (+10%). Flows appeared top-down driven, with sub-sector-level trading dominating over single-stock moves. Post-bell, APP fell -5% despite a headline beat/raise.

On the macroeconomic front, January Nonfarm Payrolls were stronger than expected, rising +130k (vs. +65k consensus and +35k whispers). Average Hourly Earnings (AHE) increased +40bps MoM (vs. +30bps expected), and the Unemployment Rate declined to 4.3% (vs. 4.4% consensus). The market is still pricing in approximately two rate cuts by year-end, though the timing of the first cut has shifted to July from June.

Activity levels on the trading floor were moderate, rated a 4 on a 1-10 scale. The floor ended +133bps to buy, compared to a 30-day average of -81bps. Despite sharp factor moves, overall activity was muted. Asset Managers were roughly flat, with supply in Managed Care following negative updates from HUM and MRNA, and to a lesser extent, tech. Hedge Funds ended as net sellers (-$1 billion), with broad supply across all sectors, led by Financials, Tech, Healthcare, and REITs.

Goldman Sachs’ GIR team noted that the BLS introduced a methodological change to its “birth-death” model for estimating net business formation. This adjustment likely boosted January's job growth by approximately 70k relative to December, increasing monthly job growth volatility going forward. The unemployment rate’s 10bp drop to 4.28% reflected strong household employment gains and residual effects from the federal government shutdown. Annual payroll survey benchmarking resulted in a 75k downward revision to average monthly job growth for April 2024-March 2025, with 10k of this tied to cyclical business formation. The birth-death model’s contribution to payroll growth was revised down by 27k jobs/month for April-December 2025.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!